40+ are points on a mortgage tax deductible

Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Otherwise you may be able to deduct your mortgage points.

2022 Outlook Q A Crypto Inflation And Energy Transition Vaneck Rest Of Asia

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web For example if your mortgage points totaled 5000 and you took out a 15-year fixed youd be able to deduct roughly 333 annually 5000180 months 2778 x. Lock Your Rate Today.

Web Your mortgage points may be fully tax-deductible the year you paid them if the right set of criteria is met. Web Yes you can deduct points for your main home if all of the following conditions apply. Homeowners who bought houses before December 16.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web For mortgage interest to be deductible the mortgage must be secured by your home and the proceeds must be used to build buy or substantially improve your. Theyre equal to mortgage interest paid up front when you receive your mortgage.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

The mortgage is used to buy build or improve the home and the. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Comparisons Trusted by 55000000.

Get Instantly Matched With Your Ideal Mortgage Lender. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. They must deduct the remaining points over 360.

Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Private mortgage insurance Not so great news.

Web What are mortgage points. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them.

Web Most homeowners can deduct all of their mortgage interest. Ad 10 Best Home Loan Lenders Compared Reviewed. Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000.

Web Is mortgage insurance tax-deductible. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. One point equals 1 of the mortgage loan amount.

If the amount you borrow to buy your home exceeds 750000 million. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Texas Home Buying What Are Mortgage Points And Should You Buy Them

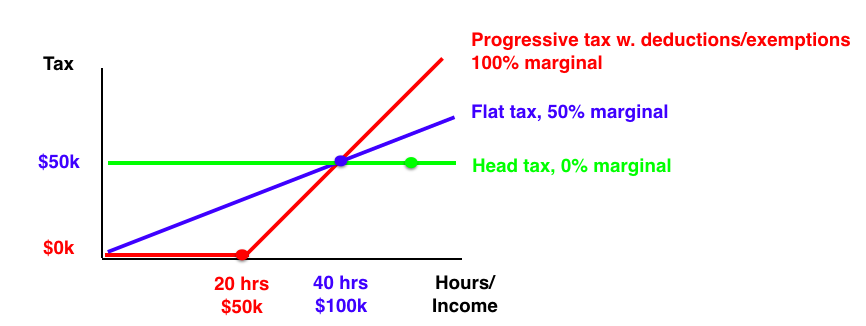

Tax Graph Seeking Alpha

Euribor Interest Rates Calculation Examples Forecasts

It S Peak Mortgage Shock Time Interest Co Nz

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

Best No Foreign Transaction Fee Credit Cards Of March 2023 Creditcards Com

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

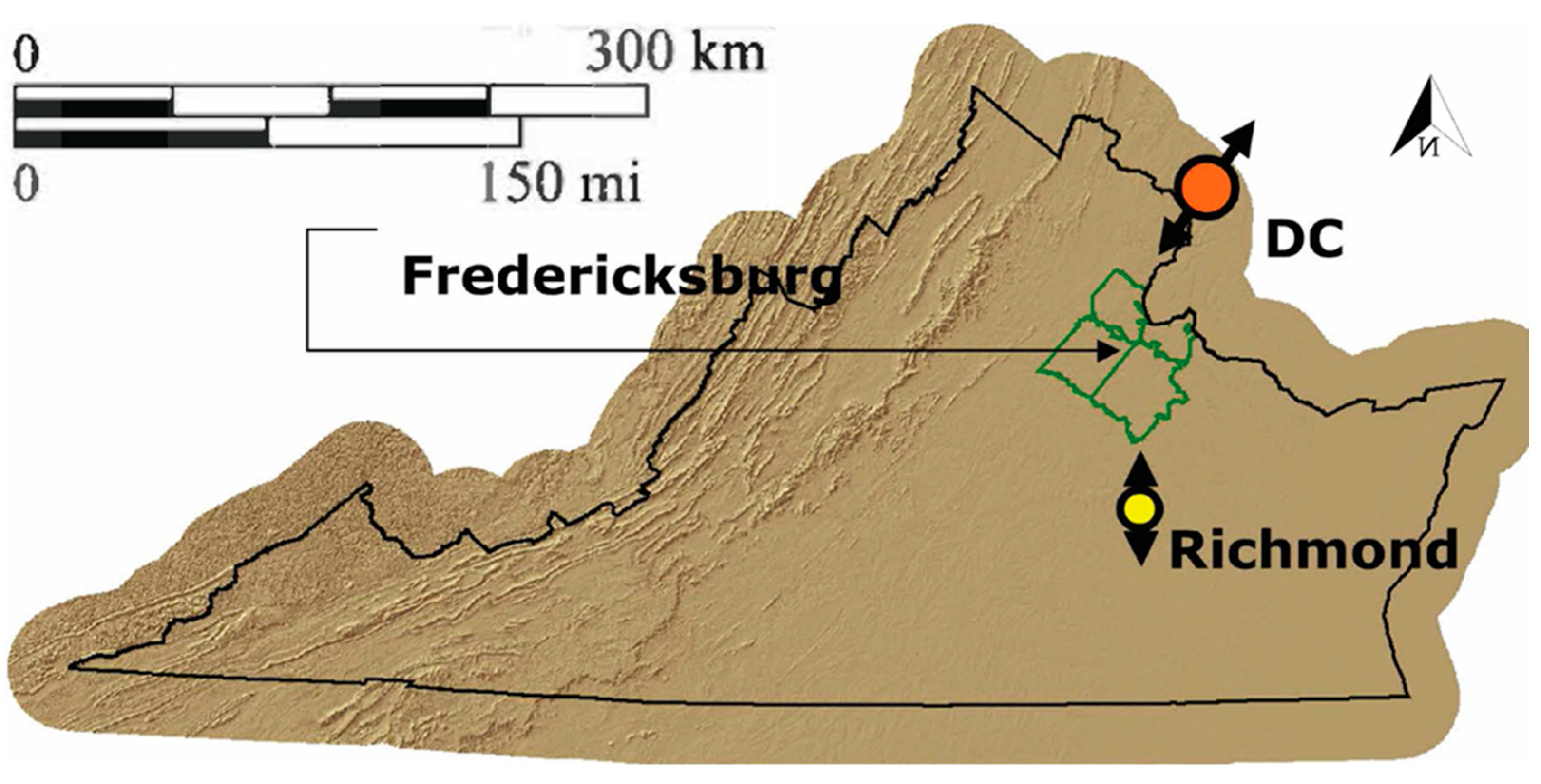

Land Free Full Text Optimal Regional Allocation Of Future Population And Employment Under Urban Boundary And Density Constraints A Spatial Interaction Modeling Approach

How Much Savings Should I Have Accumulated By Age

Can I Deduct Mortgage Points On My Taxes

Amex Platinum Card Review 80 000 Point Bonus New Perks And Credits

Are Mortgage Points Tax Deductible Pillar Mortgage Llc

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Best Mortgage Company To Lower Your Interest Rate Today

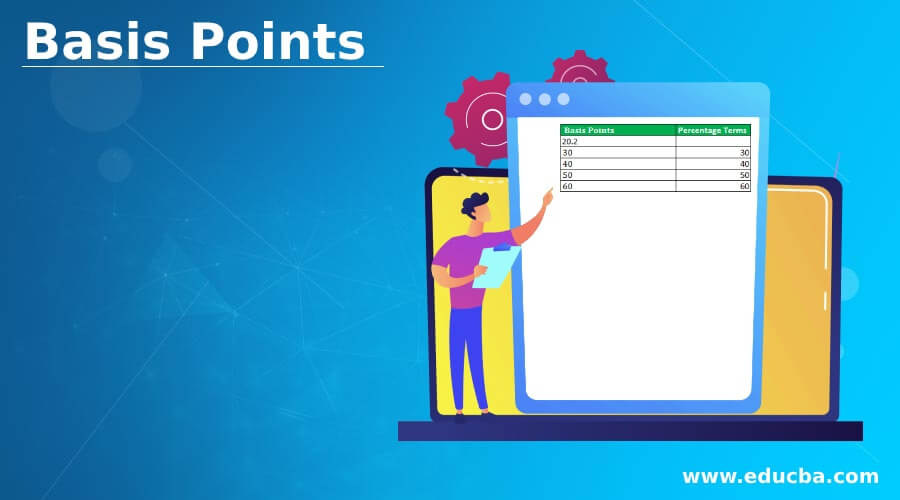

Basis Points How To Convert Basis Points To Percentages

Deducting Home Mortgage Points How To How Much To Deduct Pocketsense